Featured

Table of Contents

- – The Ultimate Guide To Navigating Debt Relief O...

- – Actual Experiences of Families Who Found Freed...

- – Consumer Rights Under State Law for Dummies

- – An Unbiased View of Actual Experiences from I...

- – The smart Trick of How Waiting Your Debt Pro...

- – The smart Trick of Local Resources for Finan...

Using for credit score card financial obligation forgiveness is not as basic as requesting your equilibrium be erased. Creditors do not readily use debt mercy, so recognizing how to offer your situation successfully can boost your chances.

I would certainly such as to review any kind of alternatives offered for reducing or resolving my financial debt." Debt mercy is not an automatic alternative; oftentimes, you need to work out with your creditors to have a portion of your balance minimized. Bank card companies are typically available to settlements or partial mercy if they think it is their finest possibility to recoup some of the cash owed.

The Ultimate Guide To Navigating Debt Relief Options and What You Need to Know

If they provide complete mercy, obtain the contract in writing before you accept. You might need to submit a formal created demand clarifying your hardship and just how much forgiveness you need and provide documentation (see next area). To work out effectively, attempt to comprehend the financial institutions position and usage that to provide a solid situation regarding why they must work with you.

Below are one of the most common mistakes to avoid at the same time: Financial institutions will not just take your word for it. They require proof of financial challenge. Always ensure you get verification of any type of mercy, negotiation, or difficulty plan in writing. Creditors might use less alleviation than you need. Bargain for the ideal possible terms.

The longer you wait, the much more charges and interest accumulate, making it tougher to certify. Financial obligation mercy entails legal considerations that debtors need to understand prior to continuing. Customer protection laws regulate just how creditors take care of forgiveness and negotiation. The adhering to federal regulations assist protect customers looking for financial obligation mercy: Prohibits harassment and abusive debt collection methods.

Actual Experiences of Families Who Found Freedom Can Be Fun For Anyone

Requires financial institutions to. Ensures fair methods in loaning and repayment settlements. Restrictions costs and avoids unexpected rates of interest hikes. Requires clear disclosure of settlement terms. Bans debt negotiation business from billing ahead of time costs. Needs companies to divulge success prices and potential risks. Recognizing these protections assists avoid rip-offs and unreasonable financial institution techniques.

Making a payment or even recognizing the financial obligation can reboot this clock. Even if a financial institution "costs off" or composes off a financial debt, it does not mean the debt is forgiven.

Consumer Rights Under State Law for Dummies

Prior to concurring to any layaway plan, it's a great concept to inspect the law of restrictions in your state. Lawful implications of having debt forgivenWhile financial debt forgiveness can ease financial problem, it comes with potential legal effects: The internal revenue service treats forgiven financial debt over $600 as gross income. Consumers receive a 1099-C kind and has to report the quantity when declaring tax obligations.

Below are a few of the exemptions and exceptions: If you were insolvent (suggesting your overall financial obligations were higher than your total assets) at the time of mercy, you may omit some or every one of the canceled financial obligation from your gross income. You will certainly need to load out Kind 982 and connect it to your tax obligation return.

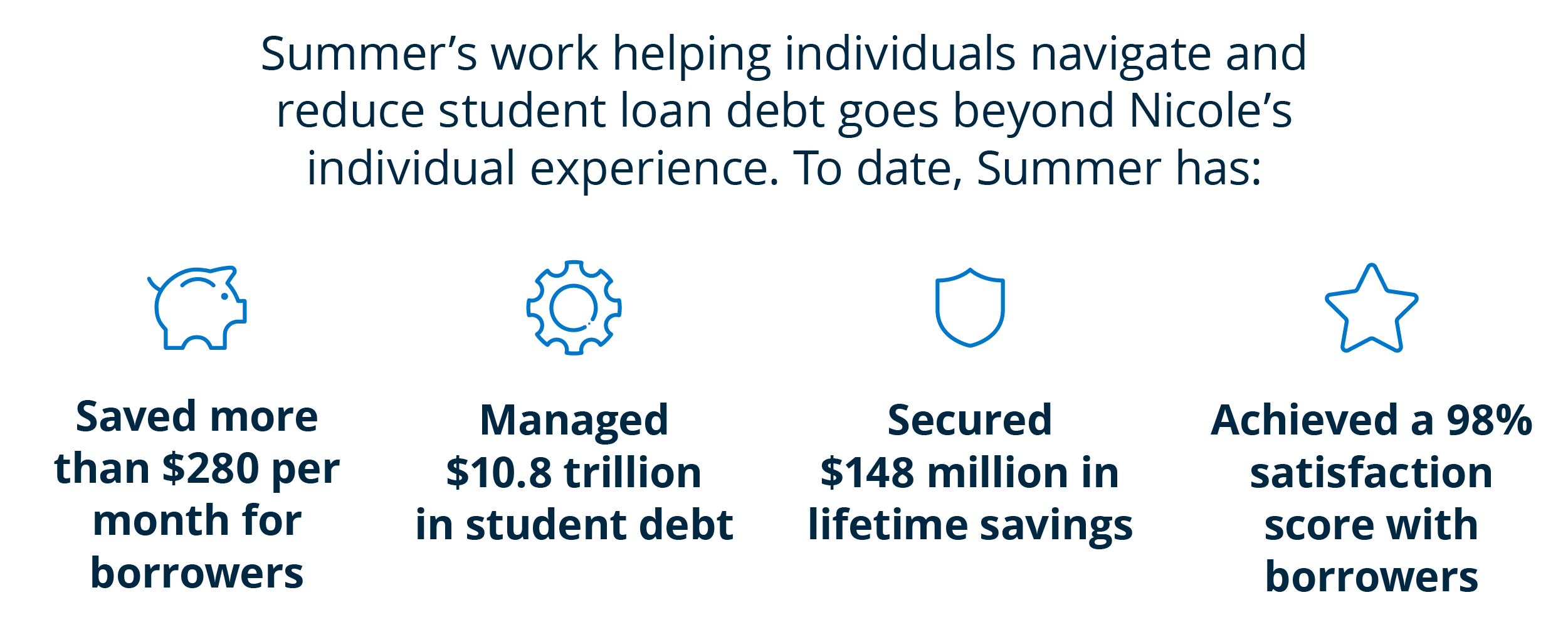

While not connected to bank card, some student finance mercy programs allow financial debts to be terminated without tax obligation effects. If the forgiven debt was connected to a qualified farm or organization procedure, there may be tax obligation exemptions. If you do not certify for financial debt mercy, there are different debt alleviation techniques that may help your situation.

An Unbiased View of Actual Experiences from Individuals Who Secured Freedom

You obtain a brand-new loan huge enough to pay off all your existing bank card balances. If accepted, you utilize the brand-new lending to settle your charge card, leaving you with simply one month-to-month payment on the loan consolidation financing. This streamlines financial debt management and can save you money on interest.

Crucially, the firm discusses with your creditors to decrease your passion rates, substantially lowering your overall financial debt concern. DMPs may also decrease or eliminate late charges and fines. They are a great debt remedy for those with poor credit rating. When all other choices fail, insolvency might be a feasible course to removing overwhelming charge card financial debt.

Allow's face it, after numerous years of greater costs, money doesn't go as far as it utilized to. Concerning 67% of Americans claim they're living paycheck to paycheck, according to a 2025 PNC Bank study, which makes it hard to pay for debt. That's particularly true if you're bring a large financial debt equilibrium.

The smart Trick of How Waiting Your Debt Problems May Cost You That Nobody is Discussing

Loan consolidation lendings, debt management strategies and repayment techniques are some approaches you can use to lower your financial debt. If you're experiencing a major monetary challenge and you have actually tired other choices, you might take an appearance at debt mercy. Financial debt forgiveness is when a lending institution forgives all or a few of your impressive balance on a finance or various other charge account to assist eliminate your debt.

Financial debt forgiveness is when a lending institution agrees to wipe out some or all of your account equilibrium. It's a method some people use to decrease debts such as credit rating cards, individual fundings and pupil lendings.

The most widely known choice is Public Solution Lending Mercy (PSLF), which cleans out staying federal car loan equilibriums after you function complete time for a qualified employer and make repayments for 10 years.

The smart Trick of Local Resources for Financial counseling for veterans in Georgia facing rising credit card and personal loan debt That Nobody is Discussing

That means any nonprofit health center you owe may have the ability to give you with financial obligation alleviation. Majority of all U.S. medical facilities provide some kind of clinical financial debt alleviation, according to client services support group Dollar For, not just nonprofit ones. These programs, typically called charity care, lower or perhaps get rid of clinical costs for qualified people.

Table of Contents

- – The Ultimate Guide To Navigating Debt Relief O...

- – Actual Experiences of Families Who Found Freed...

- – Consumer Rights Under State Law for Dummies

- – An Unbiased View of Actual Experiences from I...

- – The smart Trick of How Waiting Your Debt Pro...

- – The smart Trick of Local Resources for Finan...

Latest Posts

The Best Guide To Long-Term Effects of Your Credit History

Some Known Facts About Why Delaying to Seek Bankruptcy Counseling May Cost You.

Not known Facts About Forms of Loan Forgiveness for Healthcare Workers in Rural Areas You Should Know About

More

Latest Posts

The Best Guide To Long-Term Effects of Your Credit History

Some Known Facts About Why Delaying to Seek Bankruptcy Counseling May Cost You.

Not known Facts About Forms of Loan Forgiveness for Healthcare Workers in Rural Areas You Should Know About